Jio BlackRock collaboration global headquarters showcasing modern architecture and 50 CENTS IAS brand integration for a professional and innovative financial partnership

Jio Financial Services and BlackRock collaboration logo incorporating 50 CENTS IAS Institute branding, representing a modern financial partnership.

Table of Contents:

-

Introduction: Why is the Jio BlackRock Collaboration Important?

-

Origins: The Story Behind the Collaboration

-

Vision, Objectives & Regulatory Approvals

-

7 Key Impacts of the Jio BlackRock Collaboration

-

Financial Inclusion & Digital Penetration

-

Challenges & Systemic Risk

-

Boosting India’s Capital Markets

-

Corporate Governance & Global Benchmarks

-

Data Privacy & Ethical Concerns

-

India’s Soft Power & Global Financial Integration

-

Role of Policy & Government Initiatives

-

-

UPSC Insights

-

Conclusion: Future Outlook

Introduction: Why is the Jio BlackRock Collaboration Important?

Jio BlackRock collaboration marks a new era for India's investment landscape, leveraging cutting-edge digital infrastructure and global asset management expertise to foster an inclusive growth story. With the importance of financial inclusion, digital penetration, and transparent governance higher than ever, UPSC aspirants must understand how the Jio BlackRock collaboration aligns with national policy priorities and prepares India for global leadership in asset management.

The state-of-the-art global headquarters of the Jio BlackRock collaboration, branded with 50 CENTS IAS, representing innovation and partnership in financial services.

Origins: The Story Behind the Collaboration

The genesis of the Jio BlackRock collaboration lies in India’s rapidly growing investment culture and the need to channel household savings into the formal financial sector. BlackRock’s earlier venture with DSP ended due to limited digital penetration, but Jio’s massive 450 million subscriber base made this new 50:50 joint venture more promising. SEBI’s regulatory green light in 2025 was a key milestone, validating this ambitious partnership as a pillar of India’s financial transformation.

Vision, Objectives & Regulatory Approvals

The Jio BlackRock collaboration was forged with three primary objectives:

-

Democratize asset management through tech-driven solutions

-

Leverage synergies between Jio’s local digital reach and BlackRock’s international expertise

-

Operate within strict SEBI guidelines for investor protection and transparency

SEBI’s approval process confirmed strong compliance, robust risk management frameworks, and clarity in retail investor onboarding procedures. Internal and external links to SEBI regulations and policy reports ensure educational value

Jio BlackRock collaboration launch event with 50 CENTS IAS branding, capturing the moment of partnership unveiling and public engagement.

7 Key Impacts of the Jio BlackRock Collaboration

1. Financial Inclusion & Digital Penetration

The Jio BlackRock collaboration uses mobile technology and digital KYC to onboard investors from rural and semi-urban communities, building on government initiatives like Jan Dhan Yojana and Digital India. Its mobile-first approach is revolutionizing how Indians access mutual funds, ETFs, and wealth management, ultimately enhancing financial literacy and investment awareness among underserved populations.

Internal Link: Read more about Digital Financial Inclusion in India

2. Challenges & Systemic Risk.

Despite its promise, the Jio BlackRock collaboration faces fierce competition from established fintechs and banking giants like Zerodha, Groww, SBI AMC, and HDFC AMC. Uneven financial literacy can lead to mis-selling risks, while BlackRock’s immense scale raises concerns about “too big to fail” scenarios. SEBI’s strict supervision is fundamental to mitigating systemic risks without stifling innovation.

3. Boosting India’s Capital Markets.

As household savers transition from gold and fixed deposits to mutual funds, the Jio BlackRock collaboration bolsters liquidity, transparency, and risk management in India’s capital markets. Increased retail participation supports economic stability, efficient price discovery, and a broadened investor base essential for India’s growth vision.

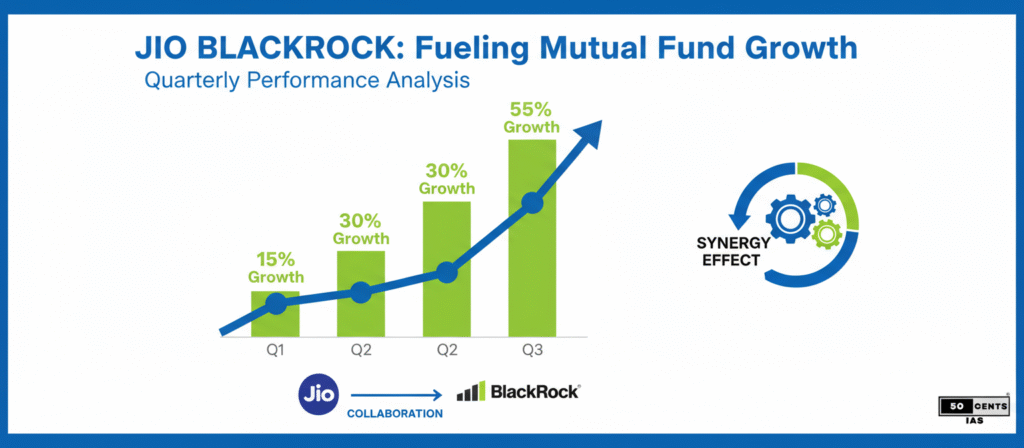

Mutual fund growth chart infographic showing positive financial trends for the Jio BlackRock collaboration, branded with the 50 CENTS IAS logo.

4. Corporate Governance & Global Benchmarks.

With BlackRock’s ESG (Environmental, Social, Governance) standards and global best practices, the Jio BlackRock collaboration compels Indian companies to increase transparency, accountability, and sustainable practices. This alignment supports international capital flows and trust among global investors, elevating India’s reputation on the world stage.

5. Data Privacy & Ethical Concerns.

Managing the data privacy of 450 million users requires the Jio BlackRock collaboration to strictly adhere to India’s Personal Data Protection Bill and global standards. Transparent usage, user consent, and ethical marketing are imperative for sustaining public trust as data-driven investment models gain traction.

6. India’s Soft Power & Global Financial Integration.

This partnership positions India as a stable, innovation-driven financial ecosystem, attracting global capital and enhancing India’s soft power. The Jio BlackRock collaboration supports India’s role in G20 financial dialogues and bolsters its international investment credibility, crucial for trade, diplomacy, and development.

External Link: Explore India’s G20 Financial Inclusion Initiatives

7. Role of Policy & Government Initiatives.

The Jio BlackRock collaboration is aligned with key government programs—Digital India, Jan Dhan Yojana, and UPI—enabling mass financial participation and payments. SEBI’s digital KYC rules make it easier for new investors to join, while financial consumer protection remains a central policy pillar.

Internal Link: India’s Mutual Fund Reforms Explained

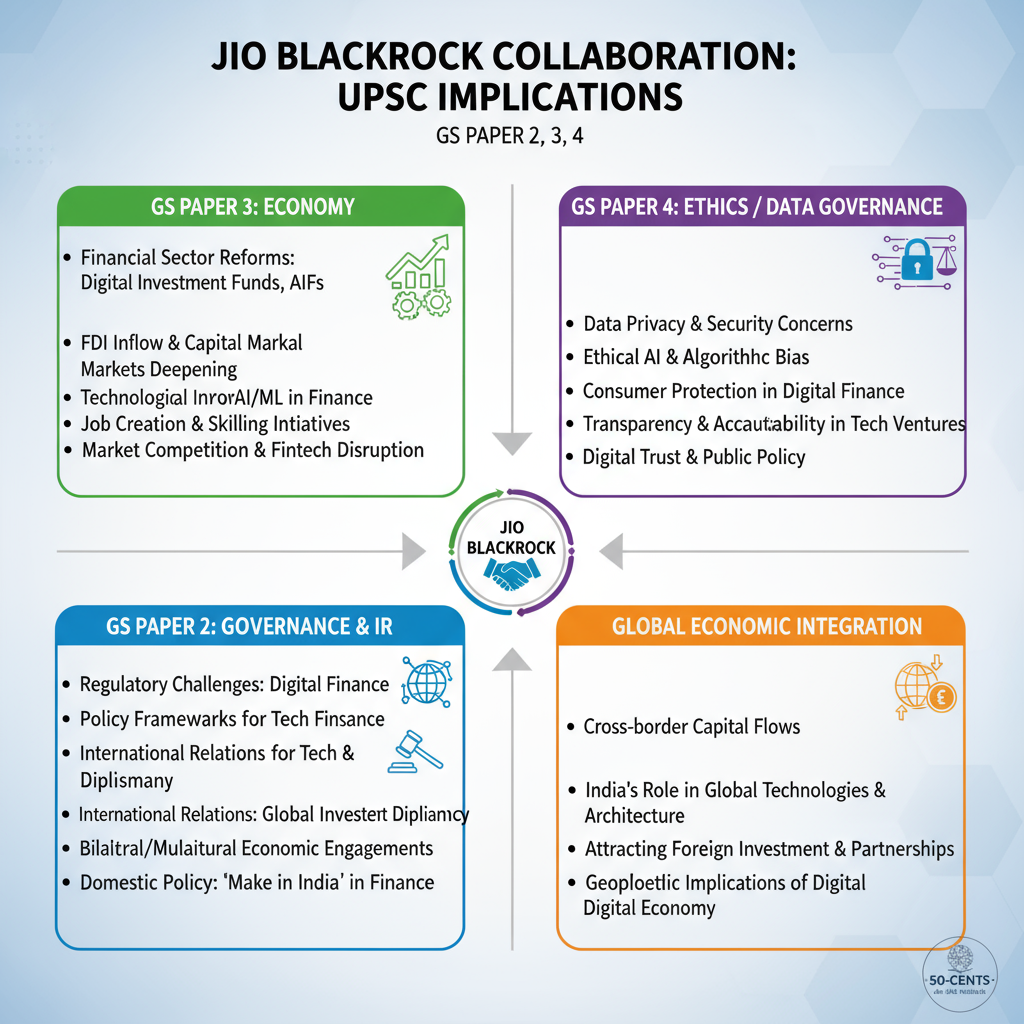

UPSC Insights

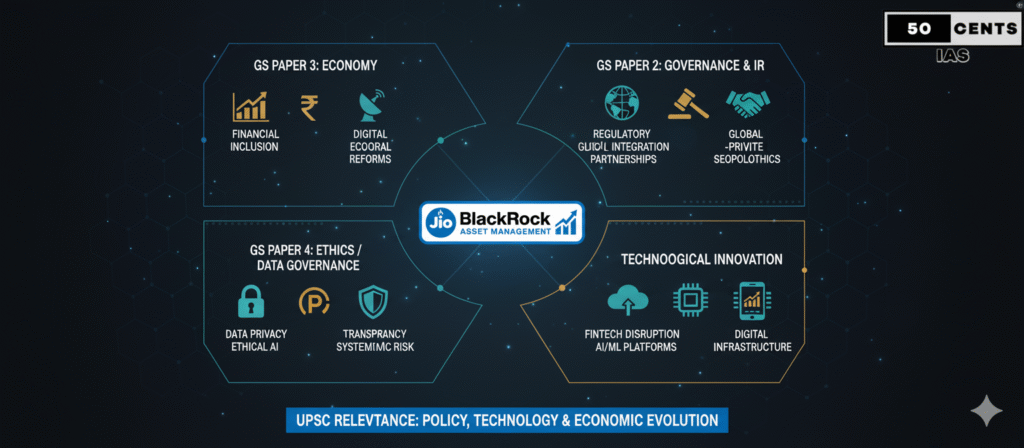

UPSC aspirants must grasp the implications of the Jio BlackRock collaboration, which touches on GS Paper 3 (Economy), GS Paper 2 (Governance & IR), and GS Paper 4 (Ethics/Data Governance). The venture showcases the interplay between domestic policy, financial sector reforms, technological innovation, data privacy, and global economic integration—core topics for upcoming examinations.

Jio BlackRock: India's financial future takes shape. (Source: Jio BlackRock / 50 CENTS IAS)

The emblem of change: Jio BlackRock at the forefront of India's asset management evolution.

Conclusion: Future Outlook for India’s Asset Management Sector.

The Jio BlackRock collaboration is more than a business deal—it’s a blueprint for the future of financial inclusion, governance, and global integration in India. For UPSC aspirants, investors, and policymakers, learning from this example can inspire better understanding of policy drivers, regulatory checks, and technology’s role in economic development. As challenges emerge, this partnership will continue to be a benchmark for asset management innovation.

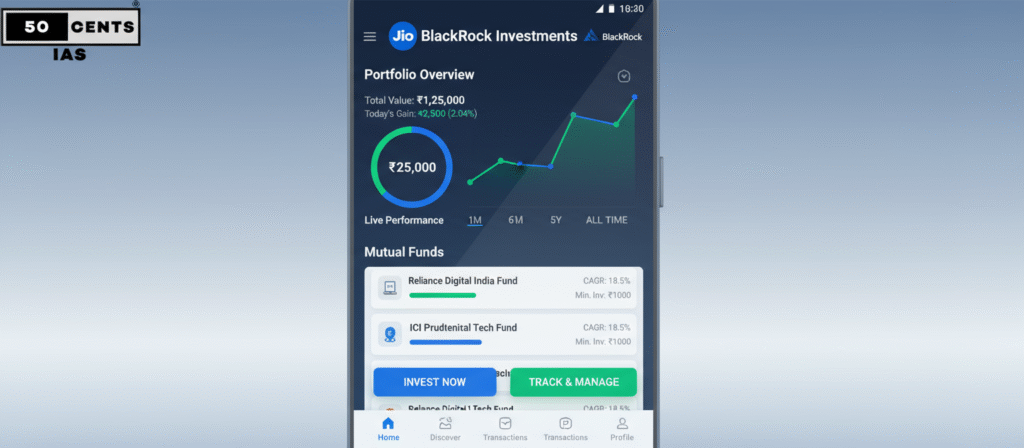

Digital investment interface of Jio BlackRock collaboration app highlighting portfolio overview and mutual fund growth with 50 CENTS IAS branding

FAQ on Jio BlackRock Collaboration (SEO & UPSC Focus)

1. What is the Jio BlackRock collaboration?

The Jio BlackRock collaboration is a 50:50 joint venture between Jio Financial Services and BlackRock, aiming to revolutionize India’s asset management industry by making investment opportunities more accessible through digital technology and global expertise.

2. Why is the Jio BlackRock collaboration important for UPSC aspirants?

The Jio BlackRock collaboration offers a real-world example for UPSC aspirants to understand economic reforms, financial inclusion, government policy, global partnerships, and regulatory frameworks—all crucial for GS paper topics and interviews.

3. How does the Jio BlackRock collaboration improve financial inclusion?

By leveraging Jio’s digital reach and BlackRock’s world-class products, the Jio BlackRock collaboration enables millions in rural and semi-urban India to participate in mutual funds and wealth management, lowering entry barriers and promoting financial literacy.

4. What challenges does the Jio BlackRock collaboration face?

The Jio BlackRock collaboration competes with major fintech firms and established banks. It must navigate regulatory complexity, educate new investors, and maintain ethical data practices to build trust in India’s diverse and dynamic market.

5. What are the systemic risks related to the Jio BlackRock collaboration?

Systemic risks from the Jio BlackRock collaboration include market concentration, “too big to fail” issues, and data privacy concerns—making SEBI oversight, transparency, and robust risk management critical for market stability.

6. How will the Jio BlackRock collaboration impact India’s capital markets?

The Jio BlackRock collaboration is expected to increase liquidity, diversify investor participation, and drive better corporate governance, strengthening India’s capital markets and overall economy.

7. What role does government policy play in the Jio BlackRock collaboration’s success?

Government programs like Digital India and Jan Dhan Yojana, plus SEBI’s digital KYC regulations, have set the groundwork for the Jio BlackRock collaboration’s ability to scale, innovate, and reach every corner of the country.

8. Is the Jio BlackRock collaboration safe for investors?

The Jio BlackRock collaboration operates under strict SEBI regulations and global standards, ensuring investor protection, ethical practices, and transparent communication. However, investors should always review schemes and understand risks before investing.

9. What technologies are powering the Jio BlackRock collaboration?

Technologies such as digital onboarding, app-based investing, and BlackRock’s Aladdin risk analytics platform power the Jio BlackRock collaboration, making smart investment decisions easier and safer for Indian investors.

10. How can new investors benefit from the Jio BlackRock collaboration?

New investors can benefit from low-cost funds, easy digital access, educational resources, and diversified portfolio options offered by the Jio BlackRock collaboration, making wealth creation simpler and more inclusive than ever before.

Vibhuti

Excellent article

Kashvi

The article “Jio–BlackRock Collaboration: Impact & UPSC Analysis” presents a well-researched and balanced perspective on a complex economic partnership. It effectively connects financial developments with governance and ethical dimensions, making it highly relevant for serious UPSC aspirants.

Vibha Singh Gupta.

The article “Jio–BlackRock Collaboration: Impact & UPSC Analysis” presents a well-researched and balanced perspective on a complex economic partnership. It effectively connects financial developments with governance and ethical dimensions, making it highly relevant for serious UPSC aspirants.

Satyam Singh

I’d like to commend the in-depth article titled “Jio–BlackRock Collaboration: Impact & UPSC Analysis”. The piece is both timely and well-analysed, offering a clear breakdown of how this strategic partnership could influence India’s infrastructure, investment landscape and policy ecosystem. The language is crisp and accessible, yet the analysis remains thorough, making it valuable both for aspirants and professionals alike.

Thank you for bringing such well-researched and structured content.